Three Reasons Why Physicians Should Refinance Business Loans to Pay Off Student Loans Quicker

Physicians still saddled with their medical school debt should refinance their business loans to tackle their student loans. The structure of these loans differ, both in underwriting and in guarantees. But they also differ in overall cost in their interest rates and fees.

The difference between fees and interest is a major reason why physicians should refinance their business loans first before they deal with their student loans.

SECURING YOUR LOAN

Your company needs financing, but research and due diligence puts your personal information at risk. The more options you consider, the more vulnerable you become. All lenders want to run your credit and access your personal information. Do not let them. Let Mayava find you the best rate available, safely and quickly without putting you and your company at risk.

It’s understandable that physicians focused on building their practice may not be aware of all their lending options, and how the different costs of borrowing can affect their earning potential and their professional development.

Here are three reasons why physicians should refinance their business loans to pay off their medical student loans quicker:

Interest Rates on Student Loans Are Typically Higher Than Business Loans

The average interest rate on a business loan with maturities of more than one year offered by the Small Business Administration (SBA) 7(a) small business loan program is 3 percent on any loan guaranteed by the SBA for loan amounts of $150,000 to $700,000, and 3.5 percent on loans of more than $700,000. An additional fee of 0.25 percent is imposed on any guaranteed portion of more than $1 million.

The SBA can guarantee as much as 85 percent of any loan up to $150,000 and 75 percent of any loan over $150,000. The maximum exposure that the SBA will assume for any loan is $3.75 million. For example, if a business gets a loan for $5 million, the maximum guarantee to the lender will be $3.75 million or 75 percent. By contrast, SBA Express loans have a maximum assumption guarantee of only 50 percent.

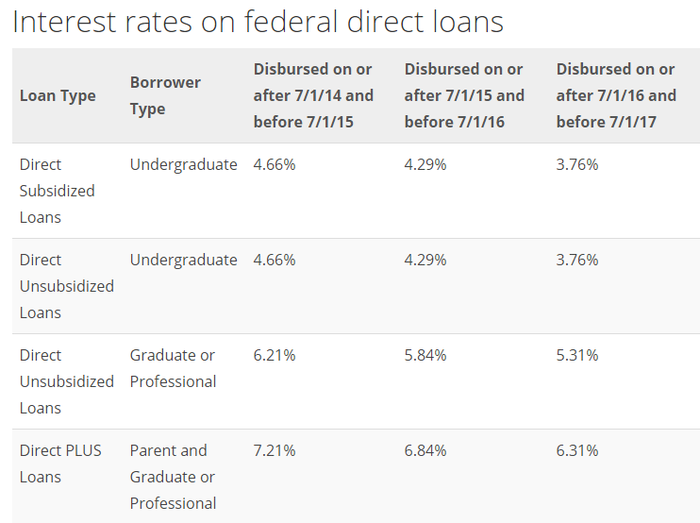

The chart below, created by the online student loan platform Credible, details the interest rate burdens that student debt holders currently face. Some 43.3 million Americans hold around $1.26 trillion in student loan debt and have a delinquency rate of 11.6 percent. As you can see, student debts carry a higher interest rate with fewer guarantees and refinancing options tied to them.

(Source: Credible)

Fewer Refinancing & Consolidation Options for Student Loans Compared to Business Loans

There are many refinancing options for business loans. Small businesses can use business loan refinancing options available from private lenders and advisory groups that let them refinance their current debt and stay out of debt going forward. Whether with an SBA loan or alternative business funding such as hard money, merchant cash advances or equity or debt financing, a medical practice can refinance its debt more advantageously by bargaining for better terms and extending the duration of the loan in the process.

Fewer refinancing and consolidation options exist for student loans. The marketplace offers privately available resources but they aren’t regulated as vigorously as commercial lenders are.

A student loan is like an investment in yourself and your future...

Moreover, student loan borrowers are often unaware that certain lending products or services might be better for their personal situation if they’d been able to do the research. A student loan is like an investment in yourself and your future, so you owe it to yourself to conduct the proper due diligence as you would if you were investing in a stock or a mutual fund. You could save thousands of dollars in the long run and guarantee yourself a sound financial future.

Thanks to new platforms such as CommonBond and SoFi, you do have the option to refinance and consolidate your existing student loans. But your choices are limited compared to what is available to small business owners. Fortunately, the marketplace is undergoing a transformation in response. As these platforms begin to securitize their debt much in the same manner as business loans, more competitive funding options and resources will emerge for student loans, further driving down the cost of borrowing and helping borrowers save money in the long run.

Impact Upon Earnings Potential and Professional Development

According to the Association of American Medical Colleges, the median level of medical school debt for the class of 2015 was $180,000. The total cost of this debt with interest could be more than $400,000 over the loan’s duration. This sum can significantly impact future earnings potential and future professional development.

Let’s put the numbers in perspective. If a student borrows $150,000, the student loan payment will be $1,726 a month on a 10-year repayment plan. Combining interest and principal, the grand total comes to $207,144.85. For a loan of $180,000, the monthly payment on a 10-year repayment plan will come out to $2,071. Adding the total interest and principal, the final repayment total will be $248,573, which works out to an additional $68,573.

Imagine what would have happened if the physician had invested the difference—almost $70,000 in this case—in a separate account for retirement or savings. Using that extra amount to pay off the principal faster would have offered a great benefit, too.

The total impact upon lifetime earnings and professional development as a result of crushing student debt loads upon physicians cannot be fully calculated but it cannot be ignored. Physicians may not be able to access funding to start a private practice or to purchase necessary medical equipment. They may not be able to find a good location, to hire staff and to acquire the state-of-the-art technology.

Physicians may also find it more challenging to pursue mundane lending resources for mortgages or credit cards as their compensation model starts to closely resemble that of independent contractors. As a result, underwriting business loans for physicians may become much more problematic.

Not only could this hamper their pursuits of starting a family or purchasing big ticket goods such as an automobile or household items but it also affects their ability to continue their professional education or obtain necessary accreditations, possibly put their career prospects in jeopardy.

“Taking Care of Business”

Because more resources and more competitive rates exist for business loans compared to student loans and since professional debts can be separated from personal debt, physicians should consider refinancing their business loans first. Certainly, it will make the pain of repayment easier to bear.

And there’s a lot to be said for that. But every physician burdened by both business and student debt should carefully consider all the options available, and determine what works best for their practice and their future development.